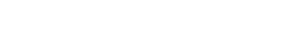

Some Highlights The housing market is moving away from the frenzy of the past year and it’s opening doors for you if you’re thinking about buying a home. Housing inventory is increasing, which means more options for your search. Plus, the intensity of bidding wars may ease as buyer demand moderates, leading to fewer homes selling above asking price. If you’re ready to buy a home, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today. … Continue reading...