Why Selling Your House with a Real Estate Professional Is Essential

Selling your house is no simple task. And when you sell on your own – known as a FSBO (or For Sale by Owner) – you’re responsible for handling some of the more difficult aspects of the process without the expert guidance you need. The 2021 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveys homeowners who recently sold their house on their own and asks what difficulties they faced. Those sellers say some of the biggest headaches are prepping their house for sale, pricing it right, and handling the required paperwork. Working with an agent is the best way to ensure you have an expert on your side to guide you at every turn. Agents have the skills and knowledge that are essential to navigating each step with ease, efficiency, and accuracy. Here are just a few things a real estate agent will do to make sure you get the most out of your sale. 1. Make the Best First Impression Selling your house requires a significant amount of time and effort. Doing … Continue reading...

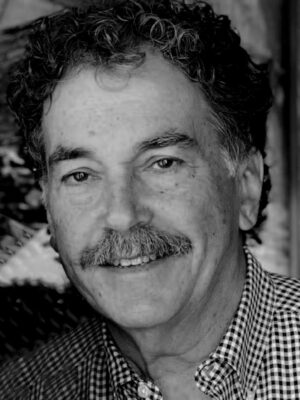

Expert Insights on the 2022 Housing Market

As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we turn to the experts. Here’s a look at what they say we can expect in 2022. Odeta Kushi, Deputy Chief Economist, First American: “Consensus forecasts put rates at about 3.7% by the end of next year. So, that’s still historically low, but certainly higher than they are today.” Danielle Hale, Chief Economist, realtor.com: “Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise. And with more than 45 million millennials within the prime first-time buying ages of 26-35 heading into 2022, we expect the market to remain competitive.” Lawrence Yun, Chief Economist, National Association of Realtors (NAR): “With … Continue reading...

5-Tips-for-Making-Your-Best-Offer-on-a-Home

As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1. Know Your Budget Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. As Freddie Mac puts it: “This pre-approval allows you to look for a home with greater confidence and demonstrates to the seller that you are a serious buyer.” Showing sellers you’re serious can give you a competitive edge, and it helps you act quickly when you’ve found your perfect home. 2. Be Ready To Move Fast Homes are selling quickly in today’s competitive housing market. According to the Existing Home Sales Report from the National Association of Realtors (NAR): “Eighty-three percent of homes sold in November 2021 were on the market for less than a … Continue reading...

Key Things To Avoid After Applying for a Mortgage

Once you’ve found your dream home and applied for a mortgage, there are some key things to keep in mind before you close. It’s exciting to start thinking about moving in and decorating your new place, but before you make any large purchases, move your money around, or make any major life changes, be sure to consult your lender – someone who’s qualified to explain how your financial decisions may impact your home loan. Here’s a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process. 1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash isn’t easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer. 2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your Home. New debt comes with new monthly obligations. New … Continue reading...

Thank You for All of Your Support

When a House Becomes a Home

It’s clear that owning a home makes financial sense. But lately, the emotional side of what drives homeownership is becoming increasingly important. No matter the living space, the feeling of a home means different things to different people. Whether it’s a familiar scent or a favorite chair, the feel-good connections to our own homes can be more important to us than the financial ones. Here are some of the reasons why. 1. Owning your home is an accomplishment worth celebrating You’ve put in a lot of work to achieve the dream of homeownership, and whether it’s your first home or your fifth, congratulations are in order for this milestone. You’ve earned it. 2. There’s no place like home Owning your own home offers not only safety and security but also a comfortable place where you can simply relax and unwind after a long day. Sometimes that’s just what we need to feel recharged and truly content. 3. You can find more space to meet your needs Whether you want more room for your changing … Continue reading...

The Perks of Putting 20% Down on a Home

If you’re thinking of buying a home, you’re probably wondering what you need to save for your down payment. Is it 20% of the purchase price, or could you put down less? While there are lower down payment programs available that allow qualified buyers to put down as little as 3.5%, it’s important to understand the many perks that come with a 20% down payment. Here are four reasons why putting 20% down may be a great option if it works within your budget. 1. Your Interest Rate May Be Lower A 20% down payment vs. a 3-5% down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate they’ll likely be willing to give you. 2. You’ll End Up Paying Less for Your Home The larger your down payment, the smaller your loan amount will be for your mortgage. If you’re able to pay 20% of the cost of your new home at the start of the transaction, … Continue reading...

The Average Homeowner Gained $56,700 in Equity over the Past Year

When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what equity is and why it matters. For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost. Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this: “Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home … Continue reading...

Homebuyers: Be Ready To Act This Winter

To succeed as a buyer in today’s market, it’s important to understand which market trends will have the greatest impact on your home search. Danielle Hale, Chief Economist at realtor.com, says there are two factors every buyer should keep their eyes on: “Going forward, the conditions buyers face are primarily dependent on two things: mortgage rates and housing supply.” Here’s a look at each one. Mortgage Rates Projected To Rise in 2022 As a buyer, your interest rate directly impacts how much you’ll pay on your monthly mortgage when you purchase a home. Rates are beginning to rise, and experts forecast they’ll continue going up in 2022 (see graph below):As the graph shows, mortgage rates are expected to climb next year. But they’re still low when you compare to where they were just a few years ago. That presents today’s buyers with some motivation to lock in a low mortgage rate before they climb higher. More Homes Are Expected To Be Available This Season The other market condition … Continue reading...